income tax rate malaysia

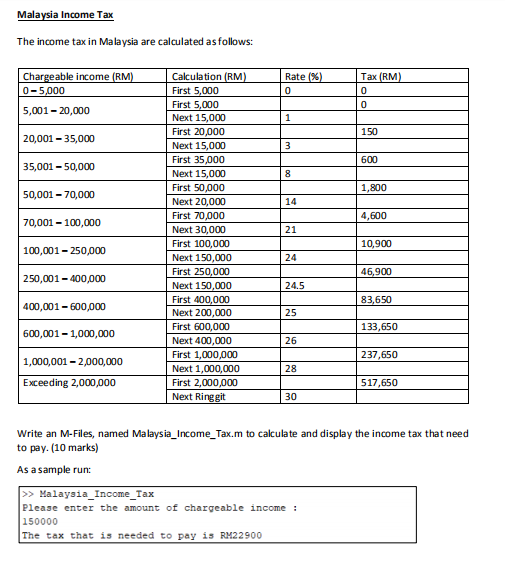

Income derived from sources outside Malaysia and remitted by a resident company is exempted from tax except in the case of the banking and insurance. A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum of 30 on chargeable income exceeding RM2000000 with effect from YA 2020.

Malaysia Personal Income Tax Guide 2020 Ya 2019

The rental income commencement date starts on the first day the property is rented out whereas the actual rental income itself is assessed on a receipt basis.

. An effective petroleum income tax rate of 25 applies on income from petroleum operations in marginal fields. 115-97 permanently reduced the 35 CIT rate on resident corporations to a flat 21 rate for tax years beginning after 31 December 2017. No other taxes are imposed on income from petroleum operations.

To the right of that bracket is. Must contain at least 4 different symbols. In case the net income exceeds Rs50 lakhs but less than Rs1 crore.

Resident individuals are subject to income tax on their worldwide income. Chargeable Income Calculation RM Rate Tax RM. A tax planner tax calculator that calculate personal income tax in Malaysia.

The deadline for filing income tax in Malaysia also varies according to what type of form you are filing. The personal income tax rate in Malaysia is progressive and ranges from 0 to 30 depending on your income for residents while non-residents are taxed at a flat rate of around 30. Ready to crunch the.

According to Section 45 of Malaysias Income Tax Act 1967 all married couples in Malaysia have the right to choose whether to file individual or joint taxes. ASCII characters only characters found on a standard US keyboard. Surcharge rate on the amount of Income Tax.

General consulting income is excluded from salary tax but is subject to tax on income see the Taxes on corporate income section in the Corporate tax summary for more information on CIT although rules exist that. Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in Malaysia. Are taxed at flat rate of 28 without any personal reliefsdeductions.

Discover latest income tax slab rates new regime and old regime updates as per the union budget Income tax slabs rates announcements videos and more. For instance a manufacturing company with a pioneer status tax incentive pays an effective tax at the rate of 72 as only 30 of its profits are subject to tax. Income tax Malaysia starting from Year of Assessment 2004 tax filed in 2005 income derived from outside Malaysia and received in Malaysia by a resident individual is exempted from tax.

Check Income Tax Slabs Tax Rates in india for FY 2021-22 AY 2023-24 on ET Wealth. For residents in other EU member states or European Economic Area EEA countries with which there is an effective exchange of tax information the rate is 19. Non-resident individuals pay tax at a flat rate of 30 with effect from YA 2020.

The surcharge is applicable. The list focuses on the main types of taxes. How many income tax brackets are there in Malaysia.

Malaysia Corporate Income Tax Rate. List of Countries by Personal Income Tax Rate - provides a table with the latest tax rate figures for several countries including actual values forecasts statistics and historical data. Leaving Malaysia without payment of tax.

US tax reform legislation enacted on 22 December 2017 PL. In Malaysia income derived from letting of real properties is taxable under paragraph 4a business income or 4d Rental income of the Income Tax Act 1967. For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021.

A company whether resident or not is assessable on income accrued in or derived from Malaysia. Non-resident taxpayers are subject to PIT at a flat rate of 20 percent on their Vietnam-sourced income. The income tax.

INCOME TAX ACT 1967 REPRINT - 2002 Incorporating latest amendments - Act A11512002. Malaysia Personal Income Tax Rate. On the First 5000.

6 to 30 characters long. Rental income in Malaysia is taxed on a progressive tax rate from 0 to 30. On the First.

Enter the tax relief and you will know your tax amount tax bracket tax rate. Non-resident individuals are taxed only on their Sri Lanka-source income. List of Countries by Personal Income Tax Rate.

Non-resident income tax NRIT rates. There is no personal income tax per se in CambodiaInstead a monthly salary tax is imposed on individuals who derive income from employment. For non-residents income obtained without a PE is taxed at the following rates.

On the First 5000 Next 15000. Find Out Which Taxable Income Band You Are In. The following incentives are given to encourage investment and relocation of manufacturing or services operations into Malaysia.

Cess is levied at the rate of 4 on the income tax payable. The long-term capital gains tax rate is 0 15 or 20 depending on your taxable income and filing status. Taxable income LKR Tax rate Cumulative tax on the taxable income equal to the higher of the range LKR Over.

0 tax rate for 10 or 15 years for new companies that invest a minimum of MYR 300 million or MYR 500 million respectively in the manufacturing sector in Malaysia. This income tax calculator can help estimate your average income tax rate and your take home pay. Chargeable income reduced rate and exempt dividend.

They are generally lower than short-term capital gains tax rates. Tax residents are subject to PIT on their worldwide employment income regardless of where the income is paid or earned at progressive rates from five percent to a maximum of 35 percent. The expenses that are not income tax deductible are initial expenses before the property is rented out.

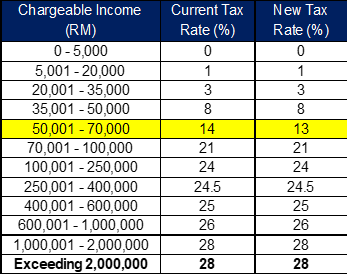

Additionally the tax rate on those earning more than RM2 million per year has been increased from 28 to 30. Dec21 Malta 35. Capital gains generated from transfers of.

Application of sections 60 and 60A to a takaful business. These Are The Personal Tax Reliefs You Can Claim In Malaysia. Corporate tax individual income tax and sales tax including VAT and GST and capital gains tax but does not.

Income Tax - Know about Govt of Indias Income tax guide rules tax efiling online slabs refund deductions exemptions calculations types of taxes FY 2022-23. Income tax exemption at a rate of 70 to 100. Dec21 Mauritania 40.

To determine your tax rate for 2023 find your tax-filing status words in bold and select the most applicable income bracket listed under your tax-filing status. Tax rates commencing from 1 January 2020 are as follows. Malaysia adopts a territorial system of income taxation.

There are no other local state or provincial. 115-97 moved the United States from a worldwide system of taxation towards a territorial system of taxation. Among other things PL.

In case the net income exceeds Rs1 crore but less than Rs. A comparison of tax rates by countries is difficult and somewhat subjective as tax laws in most countries are extremely complex and the tax burden falls differently on different groups in each country and sub-national unit. Some of the major tax incentives available in Malaysia are the Pioneer Status PS Investment Tax Allowance ITA and Reinvestment Allowance RA.

This Income Tax Calculator Shows What You Owe Lhdn Ringgit Oh Ringgit

Income Tax Formula Excel University

Taxing High Incomes A Comparison Of 41 Countries Tax Foundation

Corporation Tax Europe 2021 Statista

Malaysia Personal Income Tax Rates Table 2012 Tax Updates Budget Business News

Personal Income Tax And Top Personal Marginal Income Tax Rate 2009 Or Download Scientific Diagram

Malaysia Personal Income Tax Guide 2022 Ya 2021

Value Added Tax And Corporate Income Tax Rate Adjustment In Thailand Download Scientific Diagram

These Companies May Be Subject To The One Off 33 Prosperity Tax The Edge Markets

Individual Income Tax In Malaysia For Expatriates

Malaysian Tax Issues For Expats Activpayroll

Malaysia Personal Income Tax Rate 2022 Take Profit Org

Solved Malaysia Income Tax The Income Tax In Malaysia Are Chegg Com

Corporate Tax Rates Around The World Tax Foundation

Budget Highlight 2021 Taxletter 26 Anc Group

Cover Story Budget 2020 Top Tax Bracket Raised To 30 Tin Number Proposed The Edge Markets

How To Calculate Foreigner S Income Tax In China China Admissions

Comments

Post a Comment